Economic barometer gives Germany a catastrophic rating

German companies prefer new locations abroad: High subsidies attract!

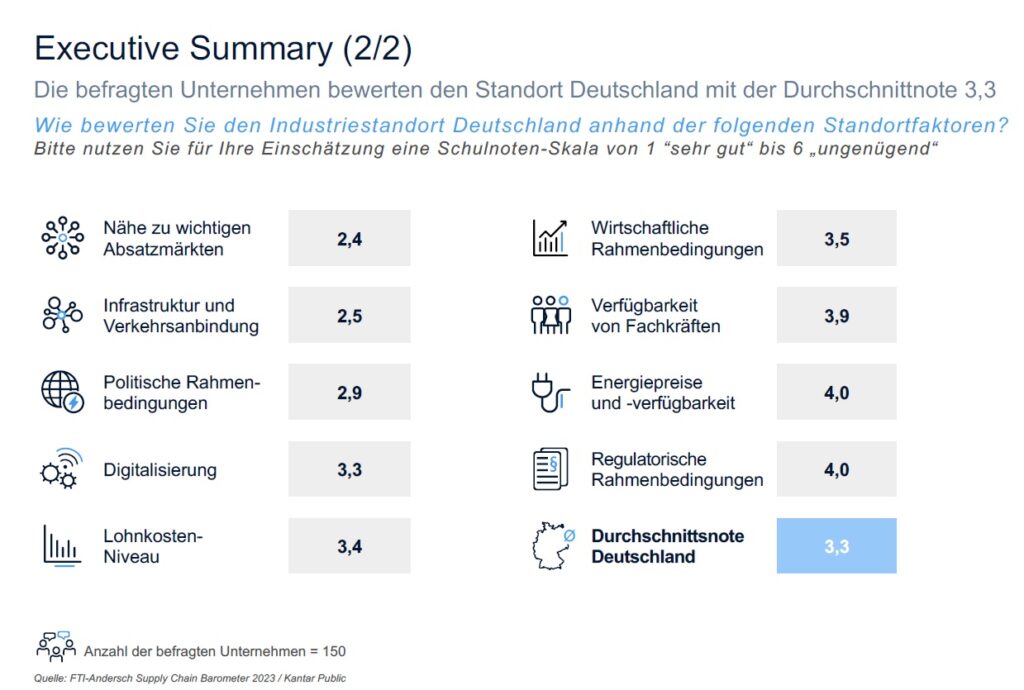

A quarter of German companies consider relocating their production abroad. A new survey by the market research institute Kantar Public and FTI-Andersch among 150 German companies shows that Germany’s location has developed negatively in the last two years. The alarming results show that a good quarter of the surveyed companies even consider relocating their production abroad. The future of Germany as a business location is in danger.

Only just over a third expect an increase in sales. Two thirds consider Germany economically no longer attractive. The energy supply is now rated particularly poorly with a grade of 4.0, which is equivalent to a D in the American grading system. The question point on state regulatory measures and bureaucracy also receives a grade of 4.0.

German firms want to invest abroad

63% of the surveyed companies have location expansions abroad in mind. Asia and Eastern Europe are now in high demand.

Other sources show that the US ‘Inflation Reduction Act’ (IRA), with a volume of $433 billion, diverts investments from Germany and Europe to the States. Matthias Krämer, head of foreign trade policy at the Federation of German Industries, reports earlier that there had already been an increased interest of German companies in the US as a business location before the introduction of the ‘Inflation Reduction Act’ (IRA) in the US. With the incentives of the IRA, this interest has now increased even further. Prof. Mariana Mazzucato, Professor of Economics of Innovation & Public Value and Founding at University College London, recommends steering the market based on strict conditions: It has to be ensured that the money goes into the right areas, such as promoting climate protection or fair working conditions. Stakeholder value and ESG principles are considered guidelines for such politically supported conditions in the global economy today. She cites green steel as an example of how sustainable industrial policy is possible. ESG stands for Environmental, Social and Corporate Governance. These are criteria by which the economy is to be politically steered.

“What we are seeing here is a major reorganization of production locations and networks worldwide,” says Christian Säuberlich in reference to the study. He is senior partner and chairman of the board of FTI-Andersch. “Countries like the USA have succeeded in increasing their own attractiveness as an investment location through indirect subsidies such as the Inflation Reduction Act or China through targeted promotion of foreign investment. For many German companies, it is an economic necessity to diversify and invest internationally even more in the future if they want to compete in the global market.”

Economic barometer gives Germany a catastrophic rating

China remains an attractive location for many companies, as the survey shows. Half of the surveyed companies consider China to be a very attractive location, both now and in the coming years. The German federal government recently presented a China strategy that evaluates the People’s Republic of China more negatively than in the past, for political reasons. Companies are asked to reduce their risks in China business, i.e., to divest there.

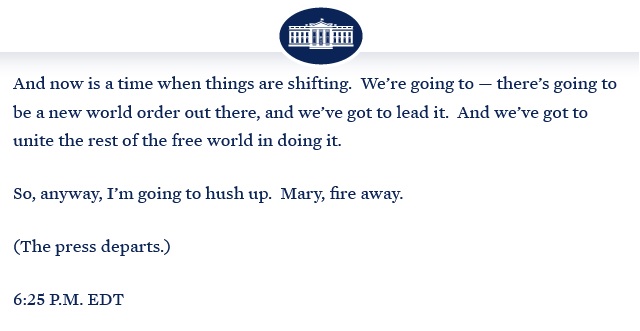

The new China strategy of the German federal government is formulated against the background of Scholz’s speech for an ‘epochal shift’ (“Zeitenwende“) in German foreign policy and a new US doctrine that emerged after the Ukraine war, which US President Joe Biden described on March 21, 2022 at the “Business Roundtable” in the White House in front of CEOs of leading American companies. There, he declared the end of the world order that has existed since World War II. “There’s going to be a new world order out there, and we’ve got to lead it,” Biden says. “We’ve got to unite the rest of the free world in doing it.”

Header image: German economy minister Robert Habeck of the Green party (Source: Symbolic collage. US Department of State 7 February 2023/17 U.S.C. § 105 “Public Property”, 652234/Pixabay)

Share this content:

10 comments